Mega Monster Metal Mayhem Portfolio

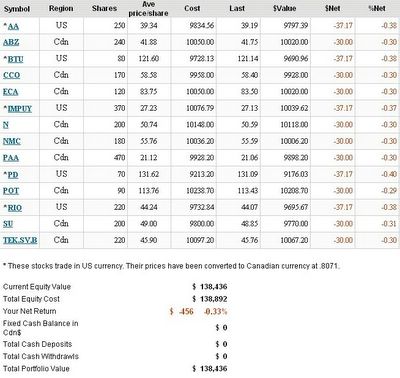

I am creating a series of model portfolios that will track resource stock performance. Don Coxe's comments on metals describe a "big picture" trend that we have been following for some time now. Since Starbucks has "tall", "grande" and "venti" sized cups, I'll be building "mini", "medium" and "mega" sized portfolios. I'll post the "mega" sized one here and the "medium" and "mini" ones on the Big Picture Speculator newsletter site. Its all about the alliteration at the Big Picture Speculator. We'll put a hypothetical ~C$10,000 into each company for an approximate starting value of $140,000.

Mega Monster Metal Mania Portfolio

Iron Ore - Companhia Vale Do Rio Doce (ADR)(RIO)

Gold - Newmont Mining Corporation (NEM, NMC.TO)

Silver - Pan American Silver (PAAS, PAA.TO)

Platinum/Palladium - Impala Platinum Ltd (ADR)(IMPUY)

Copper - Phelps Dodge (PD)

Aluminum - Alcoa Inc. (AA)

Nickel - Inco (N, N.TO)

Zinc - Teck Cominco Ltd. (TEC/SB.TO)

Uranium - Cameco (CCJ, CCO.TO)

The following commodities are not metals but they are "mined" and are included:

Potash - Potash Corporation of Saskatchewan (POT, POT.TO)

Oilsands - Suncor Energy Inc. (SU, SU.TO)

Natural Gas - EnCana Corp. (ECA, ECA.TO)

Coal - Peabody Energy Corporation (BTU)

Diamonds - Aber Resources (AVER, ABZ.TO)

If you are interested in resource stocks, the Big Picture Speculator newsletter covers a range of companies. A great book on Canadian resources is Resources Rock.

Our model portfolio's base currency is Canadian Dollars, we put ~$10,000 into each company using the Canadian listing whenever possible (with the exception of AA, PD, RIO, IMPUY and BTU). $30 commission fees were subtracted from each purchase.

Not Advice

Try the free for 30 days.

free for 30 days.

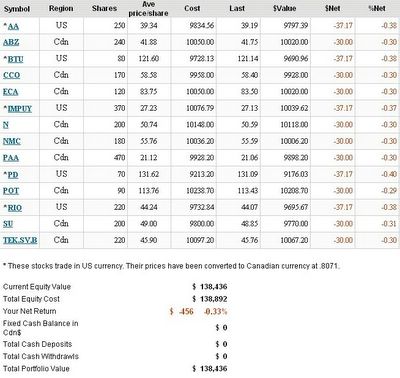

Mega Monster Metal Mania Portfolio

The following commodities are not metals but they are "mined" and are included:

If you are interested in resource stocks, the Big Picture Speculator newsletter covers a range of companies. A great book on Canadian resources is Resources Rock.

Our model portfolio's base currency is Canadian Dollars, we put ~$10,000 into each company using the Canadian listing whenever possible (with the exception of AA, PD, RIO, IMPUY and BTU). $30 commission fees were subtracted from each purchase.

Not Advice

Try the

free for 30 days.

free for 30 days.